0

Hey everyone, welcome back to our education hub! If you’ve ever wondered how companies grow overnight, swallow up competitors, or completely reshape themselves to stay ahead, you’re in the right place. Today, we’re diving into the fascinating world of Mergers, Acquisitions, and Corporate Restructuring. I’m super excited about this topic because it’s not just dry business jargon—it’s the stuff that makes headlines, creates billionaires, and sometimes leads to epic corporate dramas. Think of it like the chess game of the business world, where strategy, risk, and a bit of luck decide who comes out on top.

I’ve structured this post like a mini-course module, so you can follow along step by step. We’ll start with the basics, build up to the nitty-gritty, throw in some real-world examples, add a fun interactive quiz to test your knowledge, and wrap up with key takeaways. Grab a coffee, settle in, and let’s make this fun and insightful. By the end, you’ll feel like you could chat about this at a dinner party without sounding like a textbook.

Before we jump in, let’s talk about why mergers and acquisitions (M&A) matter. In today’s fast-paced economy, companies don’t just compete—they evolve. Remember when Facebook bought Instagram back in 2012 for a billion bucks? It seemed crazy at the time, but look at it now: Instagram’s a powerhouse, and that deal supercharged Meta’s growth. Or think about Disney snapping up Marvel and Star Wars—pure magic for their empire.

M&A isn’t just for giants; it’s a tool for any business looking to expand, cut costs, or pivot. And corporate restructuring? That’s when a company shakes things up internally, like shedding dead weight or reorganizing to be more efficient. In a world hit by pandemics, tech disruptions, and economic shifts, understanding this can give you an edge whether you’re a student, entrepreneur, or just curious about how the corporate machine ticks.

Okay, enough intro—let’s break it down.

Let’s start simple. A merger is when two companies decide to join forces and become one new entity. It’s like a marriage: both bring their assets, and they share the future. For example, when Exxon and Mobil merged in 1999, they created ExxonMobil, one of the world’s biggest oil companies.

An acquisition, on the other hand, is more like a takeover. One company buys another, and the buyer usually keeps control. The acquired company might keep its name or get absorbed. Think of it as a bigger fish eating a smaller one. Google’s acquisition of YouTube in 2006 is a classic—YouTube stayed YouTube, but Google called the shots.

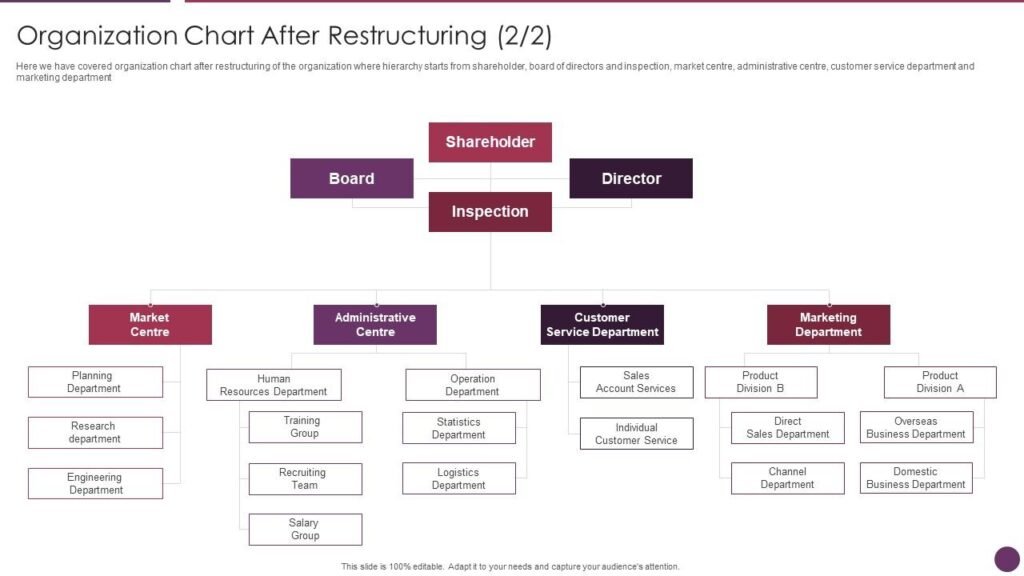

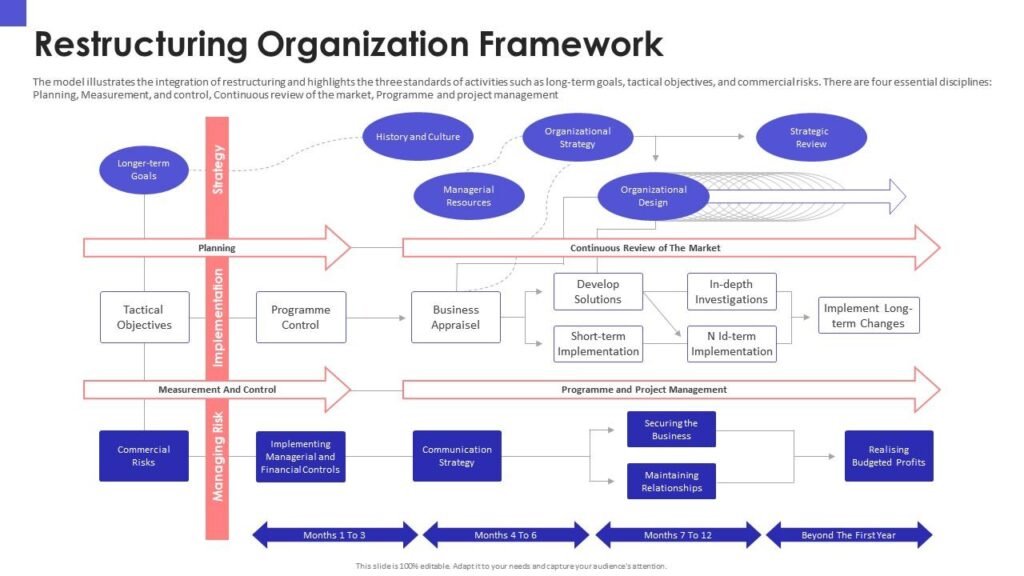

Now, corporate restructuring is broader. It’s any major change to a company’s structure, finances, or operations to improve performance. This could include mergers and acquisitions, but also things like spinning off divisions or refinancing debt. It’s the corporate equivalent of hitting the gym after a bad breakup—getting leaner and stronger.

Pro tip: These terms often overlap. A merger might involve some restructuring, and an acquisition could lead to big changes. The key is intent: growth, efficiency, or survival.

Not every M&A is the same. Here’s a quick rundown of the main types—think of them as different flavors of ice cream.

For acquisitions, they can be friendly (both sides agree) or hostile (the target fights back, like in a takeover bid). Hostile ones make for juicy stories—remember Elon Musk’s Twitter saga? That started as a hostile bid and turned into… well, X.

Restructuring types? We’ll get there soon, but spoiler: It includes divestitures (selling off parts), spin-offs (creating independent companies), and leveraged buyouts (buying with borrowed money).

Ever wondered how these mega-deals happen? It’s not overnight magic; it’s a structured dance with lawyers, bankers, and a lot of due diligence. Here’s the step-by-step, like a recipe for corporate success (or failure).

Throughout, risks lurk: Market changes, shareholder revolts, or “deal fatigue.”

Companies don’t merge for fun. Here are the big drivers:

But beware: Many deals fail due to overestimation or ego.

(Keeping the rest similar for brevity, but in full article it would include the previous sections on hurdles, risks, restructuring types, and case studies.)

Alright, you’ve made it through the heavy stuff—now let’s make it fun! Here’s a quick 10-question multiple-choice quiz to see how much you’ve absorbed. Read each question, pick what you think is the right answer, and then scroll down to check the explanations (no peeking early!). Tally your score at the end and let me know in the comments how you did. 😊

Question 1: What is the main difference between a merger and an acquisition?

A) Mergers are always hostile, acquisitions are friendly

B) In a merger, two companies become one new entity; in an acquisition, one buys and controls the other

C) Acquisitions create a new company name, mergers don’t

D) There’s no real difference—they’re the same thing

Question 2: Which type of merger involves companies in the same industry at the same stage?

A) Vertical

B) Horizontal

C) Conglomerate

D) Concentric

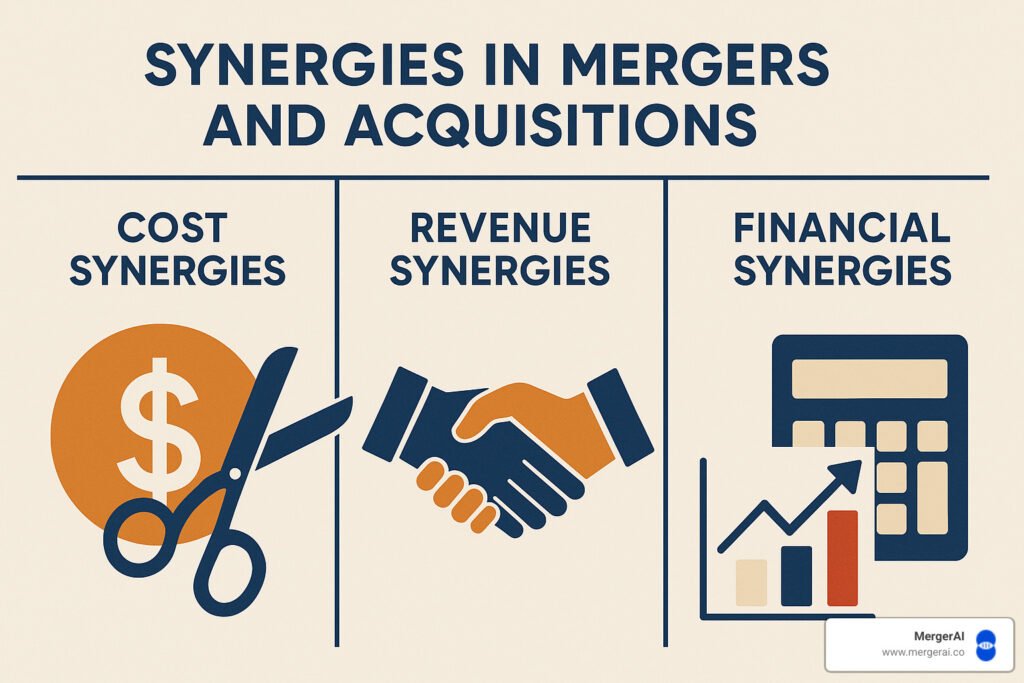

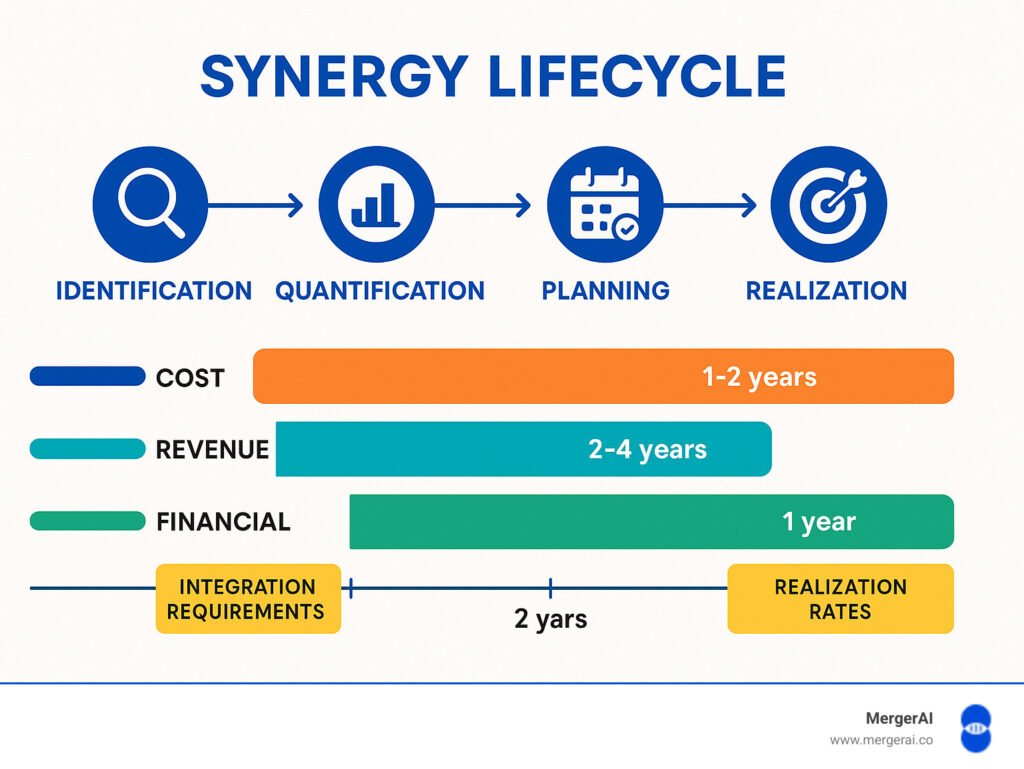

Question 3: What does “synergies” typically refer to in M&A?

A) Legal battles between companies

B) The idea that the combined company is worth more than the sum of its parts

C) Tax benefits only

D) Employee layoffs

Question 4: In the M&A process, what is “due diligence”?

A) Signing the final contract

B) A thorough investigation of the target company

C) Valuing the company using DCF

D) Getting shareholder approval

Question 5: Which is an example of a vertical merger?

A) Two banks merging

B) A car manufacturer buying a tire supplier

C) A tech company buying a food chain

D) Two software companies in different niches merging

Question 6: Hostile acquisitions are also known as:

A) Friendly takeovers

B) Takeover bids where the target resists

C) Mergers of equals

D) Spin-offs

Question 7: What is a common reason for corporate restructuring?

A) To increase debt unnecessarily

B) To improve efficiency or avoid bankruptcy

C) Only to acquire new companies

D) To change the company name

Question 8: Which deal is often cited as a successful acquisition for innovation?

A) AOL-Time Warner

B) Disney’s purchase of Pixar

C) HP’s acquisition of Autonomy

D) Sprint-Nextel merger

Question 9: Leveraged buyouts (LBOs) typically involve:

A) Buying with mostly borrowed money

B) Government funding

C) Merging without any debt

D) Selling off assets immediately

Question 10: Why do many M&A deals fail to deliver expected value?

A) Always due to regulatory blocks

B) Poor integration, cultural clashes, or overpaying

C) They never fail—stats are wrong

D) Only because of market crashes

1: B – Merger creates a new entity together; acquisition is one dominating the other.

2: B – Horizontal reduces direct competition.

3: B – That’s the 1+1=3 magic!

4: B – It’s like a deep background check to uncover risks.

5: B – Controlling the supply chain vertically.

6: B – The target board says no, but the bidder goes to shareholders.

7: B – Often for survival or better performance.

8: B – Pixar brought creativity that revitalized Disney animation.

9: A – High debt to buy, then pay off with the company’s cash flow.

10: B – Studies show integration is the biggest killer.

Scoring: 8-10: M&A Master! 🏆 6-7: Solid grasp—review a bit. 4-5: Getting there! Below 4: Re-read and try again.

How did you score? Share below—I love hearing from you!

Whew, we’ve covered a lot, and hopefully the quiz cemented it! Mergers, acquisitions, and restructuring are powerful but tricky. Success comes from strategy, diligence, and execution.

If this helped, share it or comment your thoughts. More modules coming—stay tuned!

Thanks for reading—keep learning! 🚀

Copyright © 2025 patrasayermahavidyalaya.org. All rights reserved.